Ulta Beauty Q1 Earnings: The Queen Of Cosmetics (NASDAQ:ULTA)

Frazer Harrison/Getty Images Entertainment

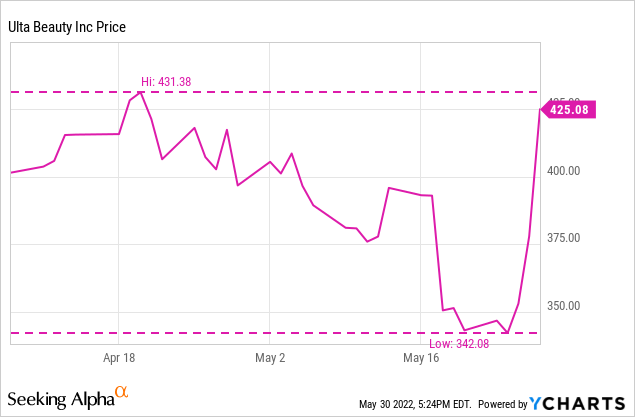

In my first article covering Ulta Beauty (NASDAQ:ULTA), I implemented a hold recommendation on it and stated investors should wait for a pullback prior to buying the stock. Since my recommendation on April 8th, Ulta did pull back down to the $345-350 range before rebounding following some phenomenal Q1 earnings results.

Last week, Ulta gained 22.8%, and as exhibited by the chart above, skyrocketed after beating earnings and more importantly, raising guidance.

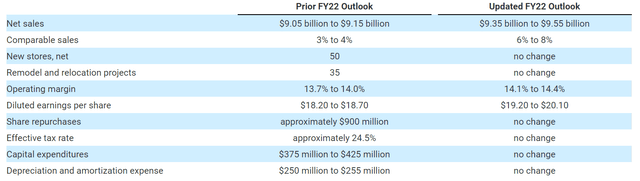

Guidance Change (Ulta Q1 Press Release)

While I was on vacation for most of last week, I wasn’t able to address the SA community regarding Ulta’s pullback and buying opportunity as the stock reached the $340-$350 mark prior to earnings.

Thesis Recap

To recap the thesis from my initial article, there were three key points that drove me to initially purchase ULTA stock.

- Strong and loyal customer base

- Growing Store Count & SSS

- Stellar Financials & Buybacks

Strong & Resilient Business Model

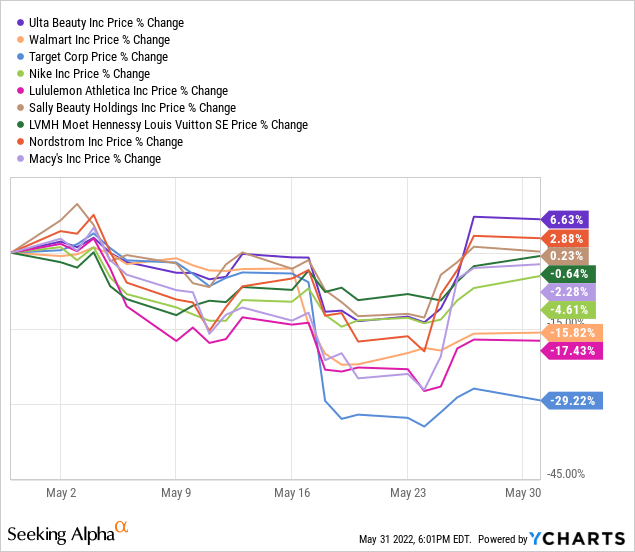

Ulta’s earnings proved that the cosmetics business is very strong. Ulta posted EPS of $6.30 (beat by $1.82) and revenue of $2.34B (beat by $220M), indicating strong growth in a challenging environment for many retailers. We can see through the 1-month stock price charts below comparing Ulta to both direct and indirect competitors, that the beauty retailer has been the best performer.

According to the company’s 10-Q:

Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, continued pressure from inflation could have an adverse impact on consumer spending and sales.

The above quote exhibits Ulta’s dominance and leadership within the cosmetics space. Furthermore, it shows that despite retail challenges, they have truly cultivated a loyal customer base, a key thesis point in my previous article that led me to buy my first share of Ulta early in 2021.

Continue to Rely on Data & Take Advantage of Trends

Through the addition of new brands and expansion of existing ones, Ulta continues to expand its product depth, driving increases in comparable sales. CEO Dave Kimbell mentioned this in the company’s Q1 earnings call.

From a trend standpoint, foundation, concealers, eyeliners, and lipstick continue to deliver strong comp growth. New brands like Fenty Beauty, REM Beauty by Ariana Grande, and Treslúce, a mass cosmetics brand founded by Latin Musician, Becky G, contributed to growth during the quarter.

While new product launches from a wide range of brands, including Clinique, Lancome, NARS, e.l.f. and NYX also delivered strong sales growth. In addition, this quarter, we expanded MAC into 233 additional stores and introduced CHANEL Beauty into 104 stores.

Ulta Beauty’s ability to sport the best brands on its shelves is a key source of its competitive advantage. As the top dog in the beauty space, brands are somewhat reliant on Ulta’s retail distribution to gain exposure to their products. The ability to sell high-profile brand names such as Ariana Grande, Becky G, and Kylie Jenner drive customer traffic and build a loyal customer base.

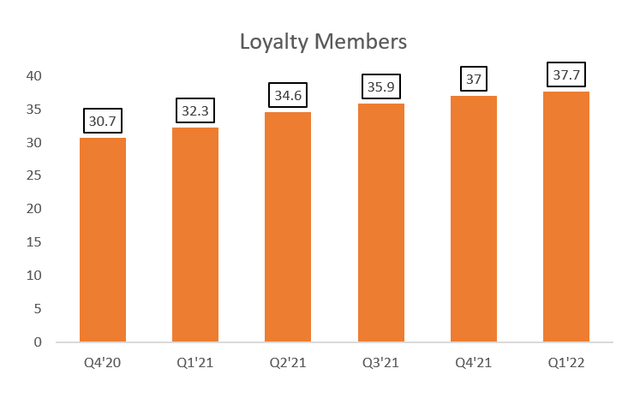

Author Created (SA Earnings Transcripts)

As demonstrated in the chart above, Ulta continues to drive customer loyalty through its rewards program, with north of 37 million “Ultamate Rewards” members.

Target Partnership Going Well

In my previous article, Ulta’s partnership with Target (TGT) was a key catalyst that had the potential to further Ulta’s revenue. As America’s 8th largest retailer generating over $100B in annual revenue, Target generates millions in foot traffic which will benefit Ulta.

In Ulta’s F’21 10-K, it mentioned that over the long-term, there was potential to have about 800 Ulta in Target locations. In the quarterly call, COO Kecia Steelman commented.

As of today, we’ve got 140 stores that are open as of today. We’re on track to open 250 plus stores with them this year, but we like what we see. When we get a member engaged in our Ultimate Rewards Program, what we’re seeing is that they’re behaving very similar to our existing loyalty members. As far as brands go, Ulta Beauty works closely with the partners, with our brand partners on the assortment, etcetera, but Target really owns the sales. So, we’re not at liberty to comment on the sales-specific performance by brand at this time.

While Ulta cannot comment on the sales-specific performance of the partnership, it had only 100 stores opened at the end of F’21 and plans to open 250 by year-end (30% of its long-term target). While it would be nice to gauge some quantitative performance metrics, I believe it is safe to say that the partnership is beneficial to Ulta.

Why Ulta May Be Able To Resist Inflation

The hottest topic affecting the markets post-COVID has been inflation and its impact on corporate America. However, Ulta mentioned inflation shouldn’t have an adverse impact on its business. In order for a business to thrive during an inflationary period, it must have pricing power in order to pass the cost onto the consumer to maintain its margins.

When asked in Q1 earnings, Kimball said that units per transaction are actually flat on a YoY basis, indicative of customers willingness to spend more per transaction.

the units per transaction were essentially flat year-over-year. So, again, we’re seeing a lot of the benefit from the continuation what I’d call a moderate promotional environment overall, coupled with the mix of brands we have that entered the assortment here over the course of the last year.

Promotional events such as the 21 Days of Beauty combined with the launch of new brands clearly keep Ulta customers coming back to stores to buy more. When asked by analyst Korinne Wolfmeyer about any noticeable shift between mass vs. prestige brands in light of inflation, Kimball said there have been no meaningful shifts in demand between the two segments.

So far, our guests are managing through it and we’re not seeing huge impacts. In fact, as I mentioned in the script, prestige makeup performed a bit higher than mass makeup….

…one of the unique things that we feel is core to our model is the breadth of our assortment, all price points, from mass to prestige, all categories, hair care and skin care, makeup and bath and fragrance. And so being able to adjust and adapt as consumers’ needs evolve has been true to our model for a long time and allowed us to manage through any disruption in the marketplace. But right now, we’re seeing strength across all aspects of our business

Further, while many may think cosmetics aren’t a necessity despite strong sales, data shows that skincare and haircare routines are still in effect. In Q1, skincare delivered strong double-digit sales comp, similar to last year’s first quarter.

Even as they increase makeup usage, beauty enthusiasts are maintaining their skincare routines. As a result, skin care delivered another quarter of strong double-digit sales comp on top of robust double-digit growth in the first quarter last year.

Moisturizers, eye serums, and acne treatments continue to drive category growth in the quarter. We also saw strong growth in sun protection and self-tanning that consumers increased travel and social activities.

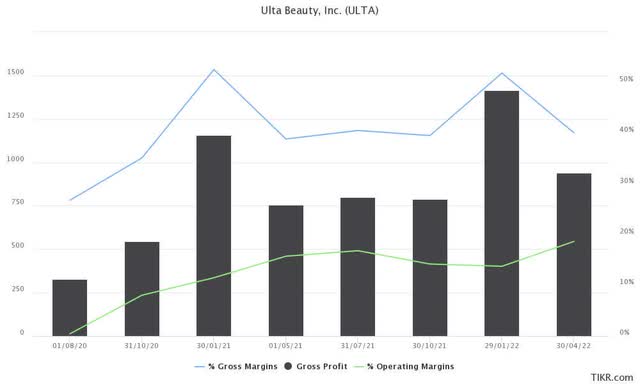

Gross & Operating Margins (Tikr)

The chart above demonstrates ULTA’s ability to consistently increase its operating margin (green line in the chart) and maintain its strong 40% gross margin (blue line) in the first quarter of 2022.

Commitment to Repurchases

As the Oracle of Omaha Warren buffet emphasizes:

The companies in which we have our largest investments have all engaged in significant stock repurchases at times when wide discrepancies existed between price and value.

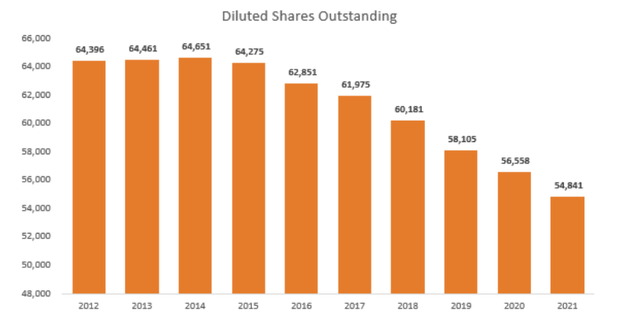

As depicted in the second picture of this article above, Ulta has committed $900 million to share repurchases for F’22. In the first quarter, Ulta repurchased 332,000 shares at a cost of $132.8 million, with an average cost per share of $400. While $132.8 million isn’t a significant repurchase, it proves that Ulta’s management believes in the stock and is focusing on reducing the outstanding share count to drive shareholder returns.

Author Created (Ulta 10-K (2012-2021))

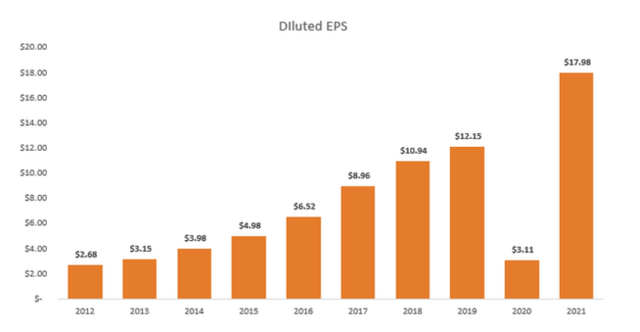

The chart above further exemplifies Ulta’s strong history of allocating excess capital, consistently reducing the diluted share count since 2014. The chart below shows Ulta’s 10-year EPS, which will continue to be supercharged via buybacks.

EPS Trend (Ulta 10-K’s)

The high end of Ulta’s EPS guidance ($20.10) implies a strong 12% YoY increase for F’22.

Valuation

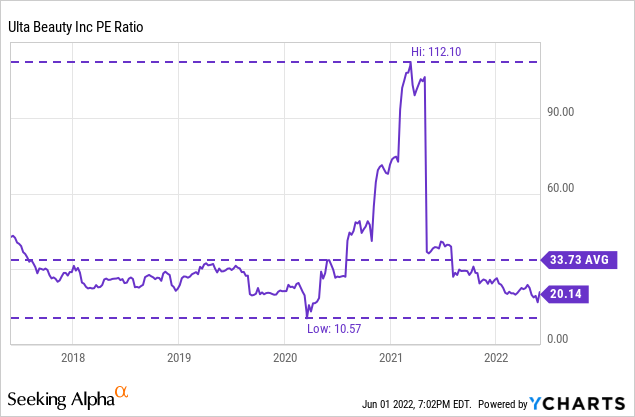

Despite Ulta’s rise in price, it still trades at a very reasonable 20x earnings. While this is higher than other retailers, Ulta’s industry leadership and higher than average margins justify its higher multiple relative to the peer group.

As portrayed by the chart above, Ulta’s P/E ratio trades at around 20x, well below its 5-year average. While Ulta is not cheap by any means, it truly is a wonderful business at a fair price. While the current macro environment may still cause short-term headwinds, Ulta still has strong fundamentals, a high-quality business model, and a reasonable earnings multiple.

Solid Business

Overall, the first quarter proved that Ulta is in fact the queen of cosmetics and beauty as a whole. With record-breaking numbers, onboarding new brands, and continuing its commitment to repurchase shares, I will upgrade my recommendation on Ulta to a buy. Yes, I know… at $401 last month, I stated it was a “Hold” and investors should wait for a pullback. The pullback did in fact occur, but Ulta rebounded immediately, now sitting just north of $400 as of this writing.

Ultimately, Ulta is a wonderful business with extremely loyal customers sporting top brands in both the mass and prestige categories. With its best-in-class loyalty program and ability to adapt to customer preferences, Ulta is an exceptional addition to one’s portfolio.